After the trauma of separation and divorce, I’ve slowly found peace and happiness as a single mom. As I mentioned a year ago, which still holds true today, this was no easy feat that required intense therapy, prayer and meditation….

The Divorce Manifesto: Love (and Divorce) in the Time of Coronavirus

“He allowed himself to be swayed by his conviction that human beings are not born once and for all on the day their mothers give birth to them, but that life obliges them over and over again to give birth…

Love in the Time of Corona

Well, we are one quarter in, and 2020 has turned out to be quite the year so far. Not what anyone had anticipated. Or as someone posted: this wasn’t on my vision board! At the start of the year, I…

How to Change the World in 2020

Reflecting on the last decade, I got married, had two miscarriages, birthed and raised a healthy baby, moved from San Francisco to my hometown, traveled internationally to China, Italy, Honduras, England, France and Mexico, bought a duplex in San Francisco,…

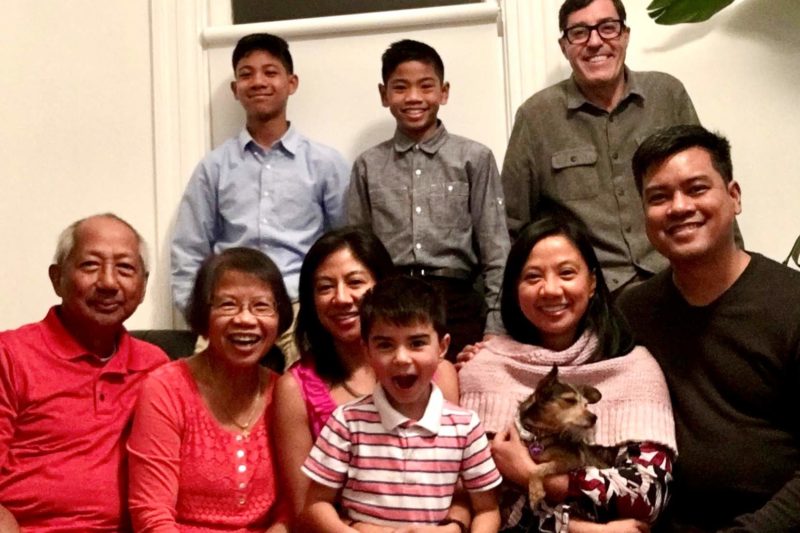

Thanksgiving 2019

Have you seen this viral video of thankfulness? I want to emulate that kind of gratitude every single day! I am thankful for the following and so much more: My beautiful son Franco who gives me joy and laughter every…

Ode to Chuck McIlvain

My friend Chuck McIlvain was one of the 34 victims from the boat Conception, which was transporting scuba divers and caught on fire on Memorial Day off the coast of Santa Barbara near the Channel Islands. This is the deadliest…

What to Know About the Lair of the Golden Bear

The Lair of the Golden Bear is UC Berkeley’s family camp located in Pinecrest, CA, which is between Tahoe and Yosemite, and a 3-hour drive from San Francisco. Note that you don’t have to be a Cal alum to camp….

Happy 44 Years

Hooray, I turned 44 years old this week. Is it just me, or does that number look ridiculously high? Today, I chopped off my hair. So liberating. And I got bangs. I wanted to change it up, and the stylist…

Reconnect: University of Chicago Booth School of Business 15-Year Reunion

I moved away from the San Francisco Bay Area for the first and only time when I was 27. It was a year after 9/11. I got my first cell phone and to this day, I have retained my Chicago…

Blessed Easter

I’m just going to go stream-of-consciousness because it’s 4/20, Holy Saturday and I haven’t shared much lately. I was interviewing for three jobs, none of which panned out. I’m not one to half-ass when it comes to preparation, resulting in…