I made it. 47 straight days of blogging. Every day seemed like a deadline, but I persevered. Hallelujah. My biggest takeaway is this: You can make things happen as long as you make it a priority. No surprise there. Even…

The Jumpin’ Bunny Festival at the Dunsmuir Hellman Estate

The Jumpin’ Bunny Festival at the Dunsmuir Hellman Estate Today we went to the Easter egg hunt at the Dunsmuir Hellman Estate in Oakland (one exit away from the Oakland zoo). We went last year and decided to go back…

Mosley’s Cafe

For Good Friday, I decided to check out Mosley’s Cafe located in the Grand Marina of Alameda. It’s a very small outdoor cafe on the water overlooking Coast Guard Island. It’s fairly new. Maybe a year or two old. They…

Guide to Point Reyes

Throwback Thursday to 5 years ago when we spent 1 night and 1 day on the Point Reyes National Seashore. As you can see from the pictures, we packed it in over a very limited timeframe. We stayed at the…

Belvedere Community Center’s Bunny Hop and Egg Scramble

This past weekend, we headed to Marin County for the Belvedere Community Center’s Bunny Hop and Egg Scramble. I go gaga for egg hunts and have scoured several different ones across the Bay Area. I’ve come to the conclusion that…

Revisit: An Exploration of World Religions

In honor of Holy Week, feel free to have a look at my blog series “An Exploration of World Religions.” I interviewed a handful of friends, locals, and an international to hear what they had to say about their religion….

A Flowchart for Choosing Your Religion

Here’s some holy week humor for you, but keep in mind some of the flows are completely inaccurate!

When Breathe Becomes Air

Now that I’m reading Noah Trevor’s biography, I’m reminded that I read Paul Kalanithi’s biography “When Breathe Becomes Air” last year and thoroughly enjoyed that as well. A prominent neurosurgeon, Kalanithi died at the age of 37 while writing his…

Emeryville Day on the Bay

Two weekends ago, while we were at the Emeryville Public Market, I picked up a handout advertising the Emeryville Day on the Bay. It sounded like fun—a free, family-friendly event recognizing the opening day of boating season, featuring live music,…

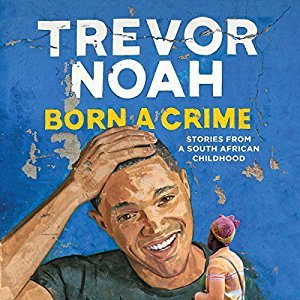

Trevor Noah’s Born a Crime

I am listening to Trevor Noah’s biography Born a Crime which documents his life as an interracial child growing up in South Africa. Frankly, all I know about Trevor Noah is that he’s a late night show comedian. Did I…