With the Supreme Court nominee hearings and Dr. Christine Blasey Ford’s testimony, I need some inspiration today. Maybe you do too? This beautiful mural ‘Born to Be Loved’ is at 1128 Lincoln Ave (Cross-street is Bay St.) in my hometown…

Who Lives, Who Dies, Who Tells Your Story

The musical Hamilton concludes with the song “Who Lives, Who Dies, Who Tells Your Story.” It’s about Hamilton’s wife and how she lived 50 years longer than her husband, how she carried out his legacy, but also about how she…

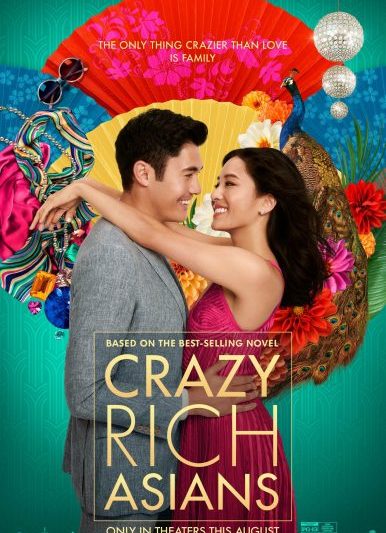

Why You Should See the Movie ‘Crazy Rich Asians’

I am all about diversity and learning about other cultures. My whole life I’ve worked hard to be open-minded and continue to broaden my perspective. In terms of movies, I’ve loved Precious, Brokeback Mountain, City of God, The Help, Slumdog…

Why The Color Run is the Happiest 5k on the Planet

We ran The Color Run this past weekend and I honestly can’t remember the last time I ran a race. The funny thing is I used to be a runner. I ran 5ks, half marathons, marathons. I ran almost daily,…

Guide to Newport, Rhode Island

I spent two days in Newport, Rhode Island last week for business travel and fell in love with the City by the Sea! I can’t wait to go back next year and tack on an extra vacation day. If I…

Honoring Nia Wilson: What to Read and Watch Now

Last week, 18-year-old Nia Wilson was brutally murdered at the MacArthur Oakland BART station. A recent graduate of Oakland High School, she was a beautiful girl with so much promise. Why do Black citizens continue to be killed for no…

Guide to Carmel-by-the-Sea

I’m currently crushing on the beach town of Carmel, which is a 2+ hour drive from San Francisco and 15 minutes away from Monterey. We headed down for the long weekend after the 4th of July. There are a lot of…

Updated Guide to Palm Springs

We spent three nights in Palm Springs this summer. Actually we stayed in Rancho Mirage at the Westin Mission Hills Resort Villas, which is 20 minutes away from downtown Palm Springs. It was a beautiful resort with three separate pools,…

The Best Sunscreens on the Market

This is my go-to sunscreen recommended by every dermatologist and esthetician I’ve seen. It’s Colorescience Sunforgettable and it’s a powder that’s really easy and convenient to apply. Because let’s face it, the sunscreen that’s easiest to use is the one that…

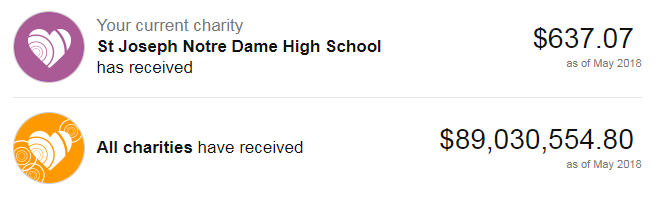

Birthday Gift: Charitable Giving

Today is my birthday! I feel so blessed and my heart is so full after spending this past weekend with family and loved ones. For Father’s Day, we celebrated with brunch at Hs Lordships, a waterfront Berkeley restaurant that’s closing…